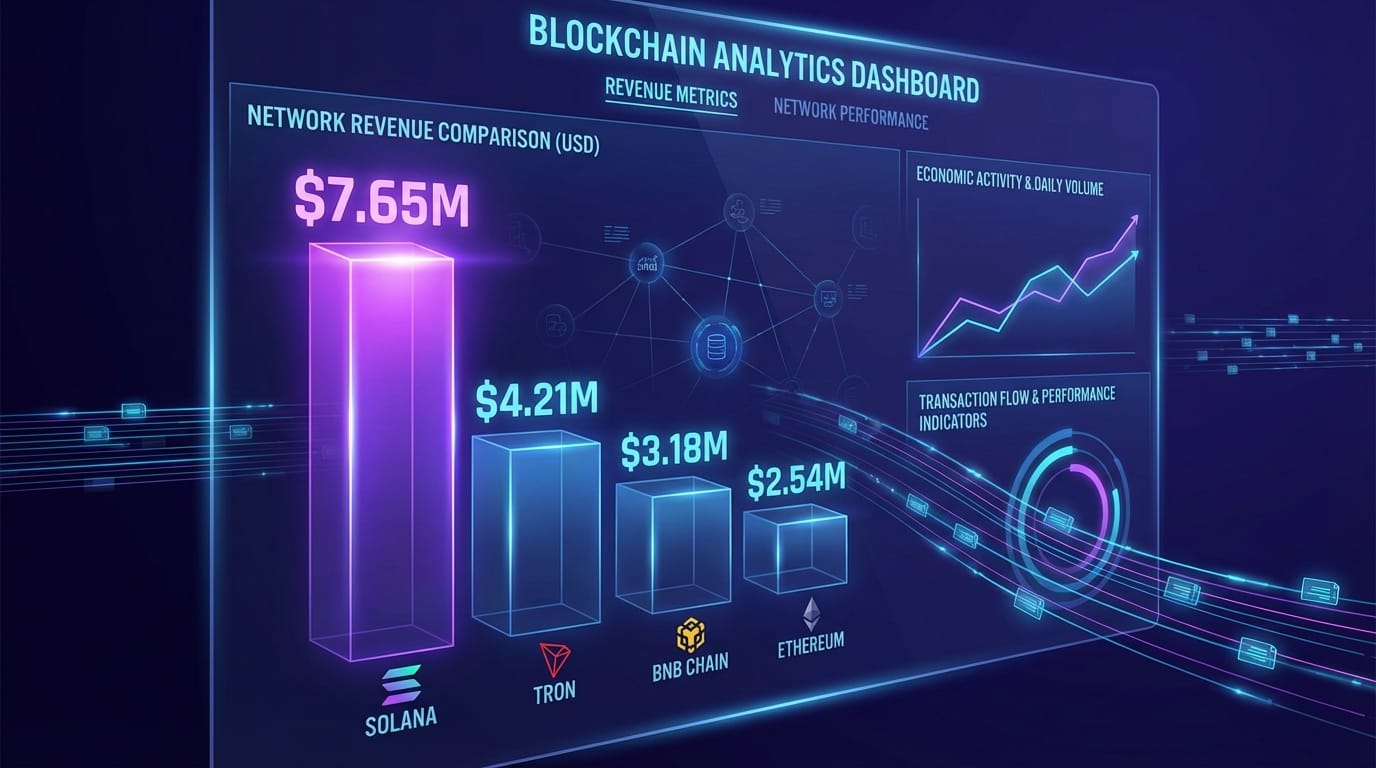

The numbers are in, and they tell a story that many in crypto didn't see coming. According to Blockworks data released this week, Solana has reclaimed the top spot as the blockchain generating the most weekly network revenue: $7.65 million. That's more than Tron ($6.4M), BNB Chain ($4.8M), and notably, more than Ethereum ($3.2M).

For anyone who's been watching the blockchain space closely, this is a watershed moment. Revenue isn't hype. It isn't social media engagement or venture capital buzz. Revenue is the purest signal of real economic activity—genuine demand for block space, application usage, and on-chain transactions.

The Revenue Metric That Actually Matters

Network revenue measures how much users are willing to pay to use a blockchain. Every transaction fee, every priority gas payment, every compute unit spent—it all adds up to a single number that reveals which networks people actually use, not just talk about.

Solana's $7.65M weekly haul isn't just impressive in isolation. It represents a fundamental shift in the competitive landscape. While Ethereum still dominates in total value locked and brand recognition, the revenue figures suggest that when it comes to actual transaction throughput and user activity, Solana is currently the most actively used smart contract platform in the world.

This shouldn't be entirely surprising. Solana processes more transactions per day than any other blockchain—often by orders of magnitude. In Q4 2023 alone, the network handled 40.7 million daily user transactions. But high transaction volume doesn't automatically translate to high revenue. The fact that Solana generates more fees despite having dramatically lower per-transaction costs than Ethereum speaks to the sheer scale of activity happening on the network.

What's Driving Solana's Revenue Dominance?

Several factors are converging to push Solana to the top of the revenue charts. First, there's the explosion of DeFi activity. Platforms like Jupiter, Raydium, and Marinade Finance have become destination applications, processing billions in volume daily. The MEV (Maximal Extractable Value) economy on Solana has also matured, with validators and searchers willing to pay premium fees for transaction priority.

Second, NFT trading on Solana has remained consistently robust. While the NFT market has cooled across the board, Solana's Magic Eden and Tensor marketplaces continue to process significant volume, generating fees that feed directly into network revenue.

Third—and perhaps most importantly—Solana has become the de facto home for consumer crypto applications. From compressed NFTs enabling massive airdrop campaigns to the Solana Mobile Stack powering the Saga and Seeker phones, the network is capturing use cases that generate consistent, high-volume fee streams. Payment apps, gaming platforms, social networks—these aren't speculative DeFi protocols, they're applications with real users making real transactions.

The Ethereum Comparison Everyone's Making

Ethereum's position at $3.2M in weekly revenue—less than half of Solana's—has sparked considerable debate. Some argue this is temporary, pointing to Ethereum's Layer 2 scaling solutions that have siphoned transaction activity (and fee revenue) away from the mainnet. Others see it as validation that Ethereum's high-fee model, while profitable during bull markets, creates friction that pushes users to faster, cheaper alternatives.

The truth is probably somewhere in between. Ethereum's Layer 2 ecosystem is thriving, with networks like Base, Arbitrum, and Optimism processing enormous transaction volumes. However, these L2s keep most of their fee revenue, only occasionally settling batches to Ethereum's mainnet. From a pure mainnet revenue perspective, Ethereum is losing ground to integrated Layer 1 solutions like Solana that don't fragment their revenue across multiple layers.

This doesn't mean Ethereum is failing—far from it. But it does suggest that the narrative of Ethereum as the uncontested leader in smart contract activity is evolving. Different models are optimizing for different outcomes, and right now, Solana's architecture is proving extremely effective at capturing revenue from high-frequency, low-cost transactions.

Technical Setup: SOL Eyes $145 Breakout

The on-chain revenue dominance is coinciding with a critical technical moment for SOL's price. Currently trading at $144.72, SOL is pressing against the $145 resistance level—a zone that has historically capped upside moves and attracted selling pressure.

A decisive break above $145 would be significant for several reasons. Technically, it would confirm a breakout from recent consolidation and likely trigger momentum-driven buying. Fundamentally, it would validate the narrative that Solana's revenue leadership should translate into sustained market cap gains.

The key question is whether Solana's strong fundamentals can overcome the technical resistance. Network revenue leadership provides a compelling fundamental backdrop, but markets often need time to digest new information. A failure to break $145 cleanly could lead to short-term consolidation as traders lock in profits near resistance.

However, the broader setup remains constructive. Solana spot ETF inflows recently hit $10.67 million, institutional interest continues to grow with firms like Sharps Technology launching Solana validators via Coinbase, and the network's economic activity shows no signs of slowing.

What This Means for Developers and Builders

For developers, Solana's revenue dominance sends a clear signal: this is where users are. High network revenue indicates deep liquidity pools, active trading markets, and user bases willing to pay for services. It's the kind of economic environment where applications can actually generate sustainable business models.

The recent launch of token extensions—features like confidential transfers, transfer hooks, and permanent delegation—has made Solana increasingly attractive for enterprise and regulated use cases. Companies like Paxos and GMO Trust have already deployed stablecoins using these extensions, recognizing that Solana offers both the technical performance and the compliance-friendly tooling they need.

The combination of raw throughput, low costs, growing institutional adoption, and now proven revenue generation creates a compelling value proposition. Solana isn't just fast and cheap—it's demonstrably generating more economic activity than competing platforms.

The Road Ahead

Solana's revenue leadership is impressive, but maintaining it won't be automatic. Competition is intensifying across the blockchain landscape, with new Layer 1s launching, Ethereum's Layer 2 ecosystem maturing, and alternative platforms like Sui and Aptos ramping up their own ecosystems.

The real test will be whether Solana can sustain this activity level through market cycles. Bull market volume is one thing; maintaining transaction throughput and fee generation during quieter periods is another. However, the diversity of use cases—from DeFi to NFTs to consumer apps to institutional tokenization—suggests a more resilient foundation than previous cycles.

For now, the data is unambiguous: Solana has become the revenue king of blockchain networks. Whether that translates into long-term market leadership remains to be seen, but the network's ability to generate more economic activity than Ethereum's mainnet marks a significant milestone in the evolution of the smart contract platform race.

In blockchain, as in any technology market, revenue is the ultimate validator. Hype fades, narratives shift, but networks that generate consistent economic activity tend to stick around. Solana has proven it can scale technically. Now it's proving it can scale economically. That's the kind of combination that defines market leaders.